So my last post went viral (thanks reddit!), and I appreciate the comments & feedback. Anyone looking for a good boss should check my post history on LinkedIn.

I received some interesting questions! Some I already answered on my website, arneknudson.com, but here’s one of the big ones:

If the reason for the layoffs isn’t post-COVID downsizing, and isn’t optimizations from AI, then what is it?

To answer that, a disclaimer first: This isn’t investment advice. Take no financial action based on this. It’s my opinion, with little actual evidence, and layered with dollops of speculation. E.g., I might WILDLY speculate that the cost of each corporate employee is $500k/year in salary+benefits+stock; ergo, cutting 30k of ‘em saves about $15BB/year.

So… why layoffs?

It comes down to Free Cash Flow (FCF). Amazon wants cash in hand.

First, GPUs are expensive. AWS is feverishly reallocating space to GPU racks. Tying up cash in infrastructure is a hefty negative to FCF, until you sell it.

Second, Trump’s economy is hurting both Amazon Retail and AWS.

Amazon Retail (both 1P and 3P) is disproportionately affected by tariffs. Case in point: when Trump eliminated the de minimis exemption, it destroyed the small 3P sellers. Amazon monitors 3P sales and, if sales are good, they’ll buy their own supply and undercut their price. But killing de minimis killed the small sellers. Amazon stopped competing, and entire product segments went “out of stock.”

Similarly, every time there’s a random tariff announcement, huge ships literally stop in the middle of the ocean and wait for Trump to go TACO. That’s a problem for the lean machine of Amazon Fulfillment.

As for AWS? It’s disproportionately affected by a downturn in the tech economy. When tech companies cut costs or go out of business, AWS’s YoY growth shrinks. Sure, AWS will be making money hand over fist on GPUs. But if AWS loses revenue from struggling non-AI businesses, they can now offset about $15BB of that. Why? So they can keep up their FCF.

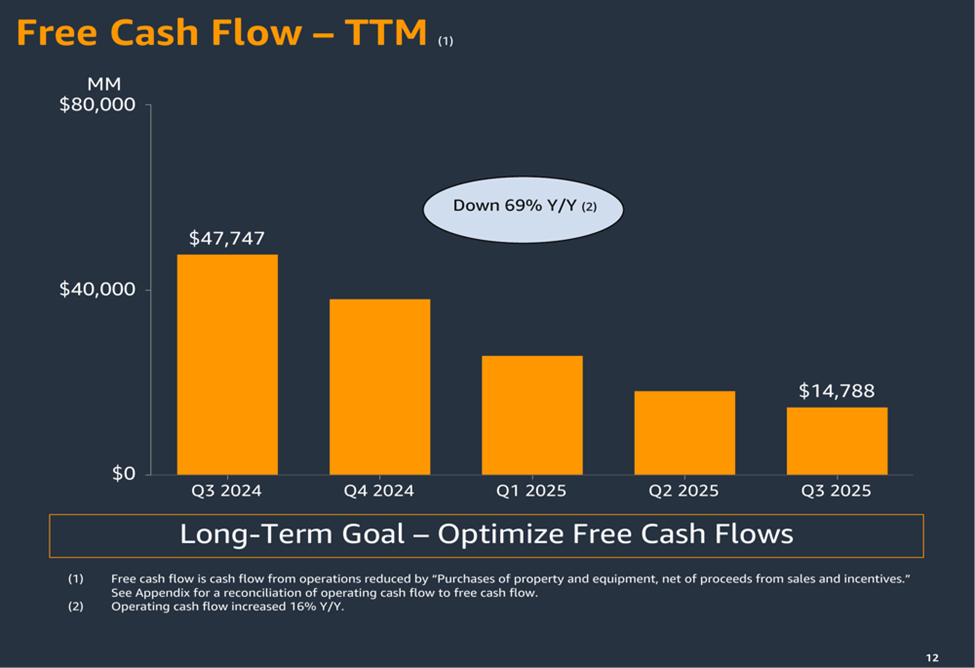

Amazon released earnings last night. Mega profits, bigly sales, stock price go brrrt, yay! But check out this slide, which is slide 12 from Amazon’s Q3 2025 earnings call slide deck:

FCF is cratering, and if the trend continues, it’s going to be about $3.2B in Q4, and NEGATIVE $5.5BB in Q1’26. (To be clear, Amazon reported ~$61BB in cash & equivalent holdings; so a negative FCF means that number will start to go down, NOT that they’re going to go into debt.)

I believe the economy is hurting Amazon Retail and AWS. And while exploding GPU costs are a problem, I think the layoffs are mostly about offsetting the tariff-related costs in Retail, maintaining AWS’s high FCF, and maximizing cash in hand for the next 12-18 months.

And maximizing cash in hand NOW is a big ol’ red flag for what Amazon thinks about the economy.

Discover more from Space on the back porch

Subscribe to get the latest posts sent to your email.

Pingback: Engineering Layoffs = More Free Cash Flow | Space on the back porch